Recently, LightCounting released its latest Access Network Optical Devices Market Report, which analyzes the market outlook for optical devices for FTTx, wireless forwarding, and wireless mid-backhaul.

LightCounting estimates that global shipments of access network optical devices will reach 127 million units in 2022, with sales of $1.77 billion. Among them, FTTx devices account for 3/4 of the shipments and 49% of sales; optical modules for forward transmission account for 22% of shipments and 40% of sales.

LightCounting noted that this is similar to their share of access network optical device shipments over the next five years (2023-2027), with PON and forwarding gray optical devices occupying the top two categories. By 2027, shipments will grow from 127 million units in 2022 to 140 million units.

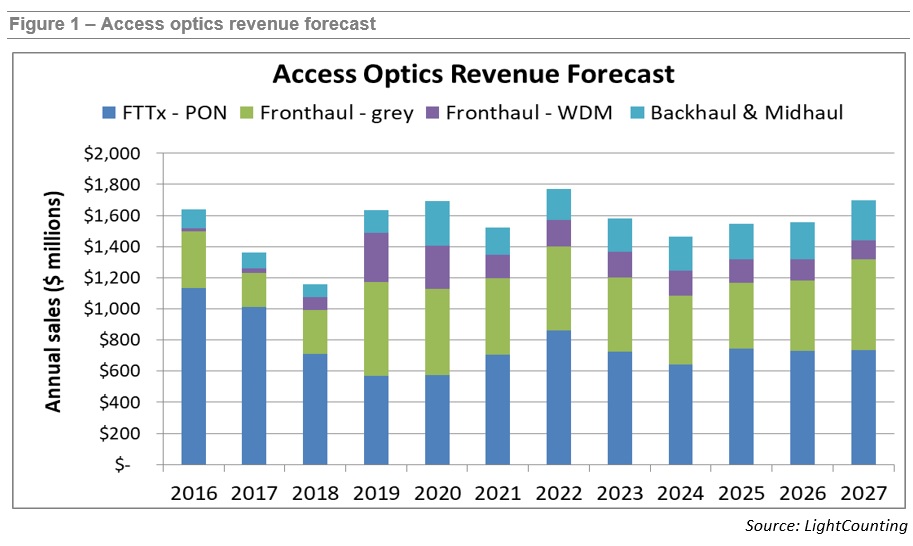

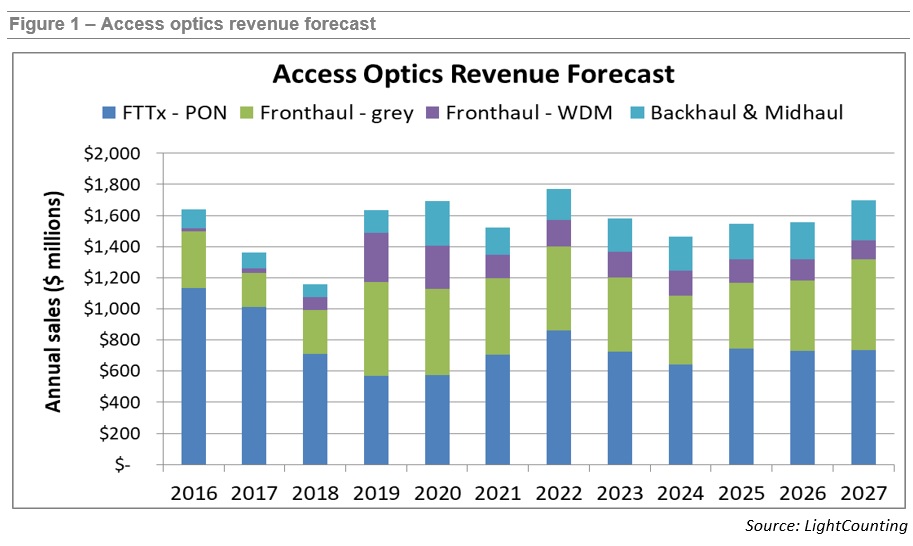

In terms of sales, annual revenue for access network optical devices is expected to reach $1.4 billion to $1.6 billion by 2027, with a decline in 2023-2024, then growth again in 2025-2027 (Figure 1). Both wireless and FTTx are cyclical markets, driven by a wave of intergenerational technology deployments, with 6G wireless and 25G/50G PON deployments expected to begin in the final years of the forecast period.

Meanwhile, over the next five years, the majority of revenue will come from 10G-PON (including XG-PON2, XGS-PON and 10G-EPON).

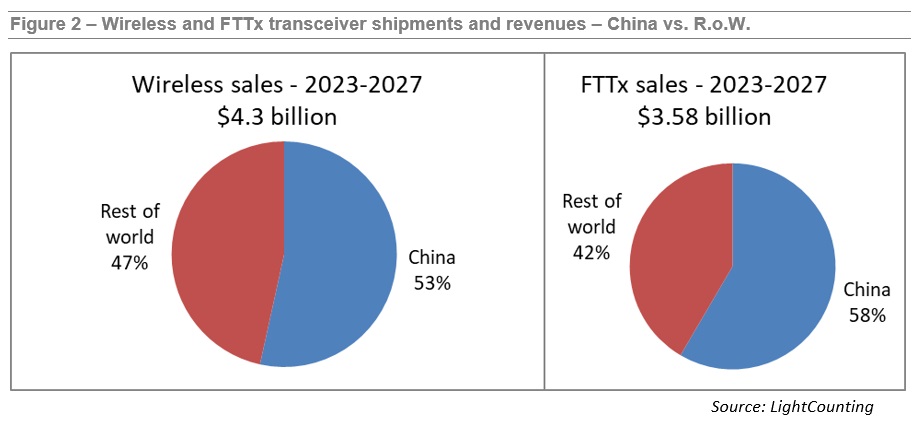

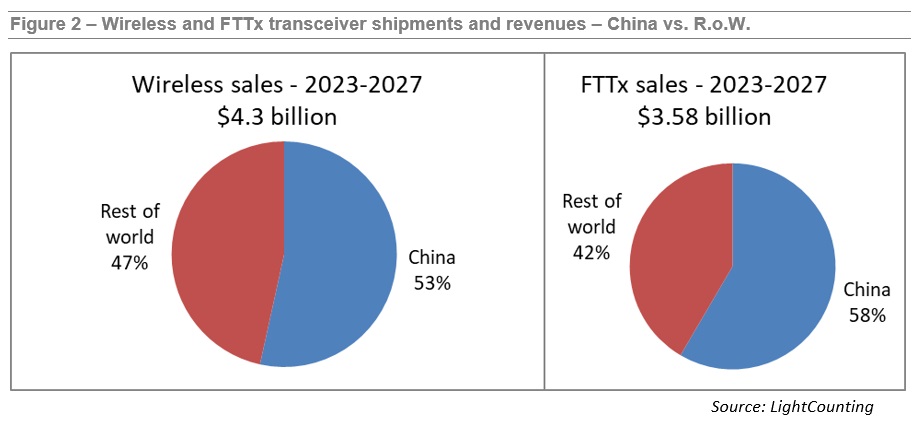

LightCounting believes that the Chinese market will continue to play a dominant role in the access network market. Figure 2 shows that China's share of global wireless and FTTx optical device consumption will remain above 50% by 2027, and that China will continue to be the largest single market in the world.

The report also mentions that current broadband access technologies include fiber, copper, coaxial cable, and cellular wireless, but several alternative technologies exist, including LMDS and millimeter wave, geostationary satellite, medium orbit satellite (MEOS), low orbit satellite (LEOS), stratospheric air platform, and low altitude air platform (UAV). These technologies will have an impact on the access network optics market over the next five years.

In addition, LightCounting mentions the ODN segment for the first time in the report, specifically the passive optical devices that provide connectivity between OLTs and ONUs in PON networks. This part is often overlooked or considered simplistic and low-value, but ODN has actually gone through several stages of evolutionary development. The current generation not only includes some creative enhancements, but also brings digitalization and artificial intelligence into the mix to reduce the cost of installing, monitoring and maintaining the network.

LightCounting projects cumulative sales of $7.85 billion for access network optical devices over the next five years, an increase of approximately 11 percent over the forecast released in April 2022. Changes in the revenue forecast include an increase in the forecast for 25G and 50G PONs and an increase in gray optical forwarding devices, although revenue from WDM forwarding devices is slightly lower than the April forecast.

Shaoxing ZKTel provides GPON OLT module, XGPON OLT module, XGSPON OLT module, XGPON COMBO OLT module, XSGPON COMBO OLT module and other full series of PON modules, and now we have started the development of 50G PON series products.

Shaoxing ZKTel Equipment Co., Ltd. is a high-tech enterprise specializing in high-end optical chips, optical components, optical modules (155M-400Gbps) and intelligent testing equipment. The company has a senior R&D team in the industry mainly with doctoral and master degree, focusing on product R&D and manufacturing in the field of optical communication. With its own brand 'ZKTel ', the products are widely used in data communication networks, transmission networks, metropolitan backbone networks, data centers, 4G/5G mobile base stations, face recognition, auto-driving and other fields.